kaufman county tax rates

Vehicle Registration 469-376-4688 or Property Tax 469. Kaufman County is responsible for judicial civil and criminal justice adult and juvenile probation human services law enforcement and jail services.

A Closer Look At Online Home Value Estimates Best Way To Invest Investing Best Investments

M - F in Kaufman Terrell and Forney.

. Counties in Arkansas collect an average of 052 of a propertys assesed fair market value as property tax per year. The County is also responsible for road and bridge maintenance in unincorporated areas maintaining public records collecting property taxes. Combined with the state sales tax the highest sales tax rate in Texas is 825 in the cities of.

The exact property tax levied depends on the county in Virginia the property is located in. The Real Estate Center-Data for Kaufman County. Falls Church city collects the highest property tax in Virginia levying an average of 600500 094 of median home value yearly in property taxes while Buchanan County has the lowest property tax in the state collecting an average tax of 28400 046 of median home value per year.

Tax rates are deemed accurate but not. 2015 Top Taxpayers Report 2014 Top Taxpayers Report. The median property tax in Arkansas is 53200 per year for a home worth the median value of 10290000.

Brenda Samples Kaufman County Tax Assessor Hours. Except for County Approved Holidays Questions. Texas has state sales tax of 625 and allows local governments to collect a local option sales tax of up to 2There are a total of 954 local tax jurisdictions across the state collecting an average local tax of 1647.

Click any Tax Jurisdiction ISD link below to view All MLS Listings for sale in that specific location. Click here for a larger sales tax map or here for a sales tax table. Rate to be used each year to appraise property receiving an exemption under Section 111825 of the Property Tax Code for Organizations Constructing or Rehabilitating Low-Income Housing.

2015_2011 TAX RATES 2014_2010 TAX RATES. Please note that property tax rates shown below do not include special assessment taxes PIDMUD Tax Assessments that may be included at newer master-planned communities throughout Dallas Fort Worth. Arkansas has one of the lowest median property tax rates in the United States with only four states collecting a lower median property tax than Arkansas.

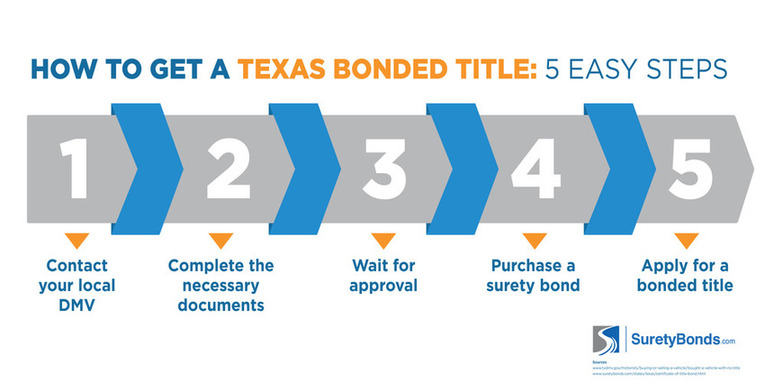

How To Get A Texas Bonded Title In 5 Steps Surety Bond Insider

Texas Property Taxes Homestead Exemption Explained Carlisle Title

Galveston Central Reduce Prop Tax

A Closer Look At Online Home Value Estimates Best Way To Invest Investing Best Investments

North Texas Property Tax Rate Comparisons

Zanata Rockwall Neon Signs Photo

Https Irsprob Com Irsprob Com Wins Again 2 Internal Revenue Service Cpa Irs

Competitive Edge Realty Real Estate Agent Nitin Gupta Awarded Associate Broker License Real Estate Agent Real Estate Broker License Estate Agent

North Texas Property Tax Rate Comparisons

Assistance With Texas Property Tax

Don T Forget To File Your Homestead Exemptions Home Trends Home Hacks Appraisal

North Texas Property Tax Rate Comparisons

North Texas Property Tax Rate Comparisons

Another Home Sold In Fallsatimperialoaks Love The Open Floor Plan The Extra Details And The Color Scheme Of This Living Room Makeover Home Open Floor Plan

North Texas Property Tax Rate Comparisons

How To Find Tax Delinquent Properties In Your Area Rethority